Data and returns as of October 2022

When we talk about Blue Chip investments, we think of names like Microsoft or UnitedHealth Group. Within the alternative asset class of wine, Bordeaux is the name. While that’s changing a bit these days as the market expands, the region's top wines remain primary blue chip investments for wine investors. Bordeaux has been producing high quality wines for a long time. Its history dates back all the way to the Romans. During all that time, winemaking has been perfected and producers have developed reputations for consistent quality.

Why does it have so many blue chip producers?

Proven Reputation- Blessed with unique soils and a favorable climate, top grade Bordeaux has few peers. The combination of natural advantages and technical know-how mean that the best producers can make exceptional wines even in challenging conditions. The region has also been building its name in the wine world for a long time. When one thinks of fine wine, Bordeaux, Burgundy and Champagne are usually what come to mind.

Source: Winetourism.com

Demand- That reputation has given the fine wines of Bordeaux a well established demand. As of the first half of 2022, Bordeaux represented nearly 34% of the total market share trading on the the London International Vintners Exchange (Liv-ex), with Burgundy coming in second place at 25.1%. This is indicative of the liquidity proposition for Bordeaux. Compared to emerging names within fine wine, investors don’t have to worry as much about whether Chateau Margaux or Lafite Rothschild will have buyers and sellers. It’s an established piece of the market.

Ageability- This is a major component of wine investing. Bordeaux’s high tannin wines possess the ability to age over long spans of time, providing a catalyst for increases in demand over time. Some of the finest Bordeaux aren't at their peak until at least 10 years after bottling, while many can age for much longer. The combination of aging and reputable demand helps drive up the value of blue chip wines. This can create a more predictable nature to how prices will behave as vintages enter ideal drinking windows.

Rarity- Some of the most prestigious and investible Bordeaux wines are produced in small quantities relative to commercial wines made in huge volumes. Given the number of buyers looking for these wines, and those who purchase en primeur (before the wine is even bottled), it is much more difficult to get your hands on a case. This drives secondary market pricing.

Returns

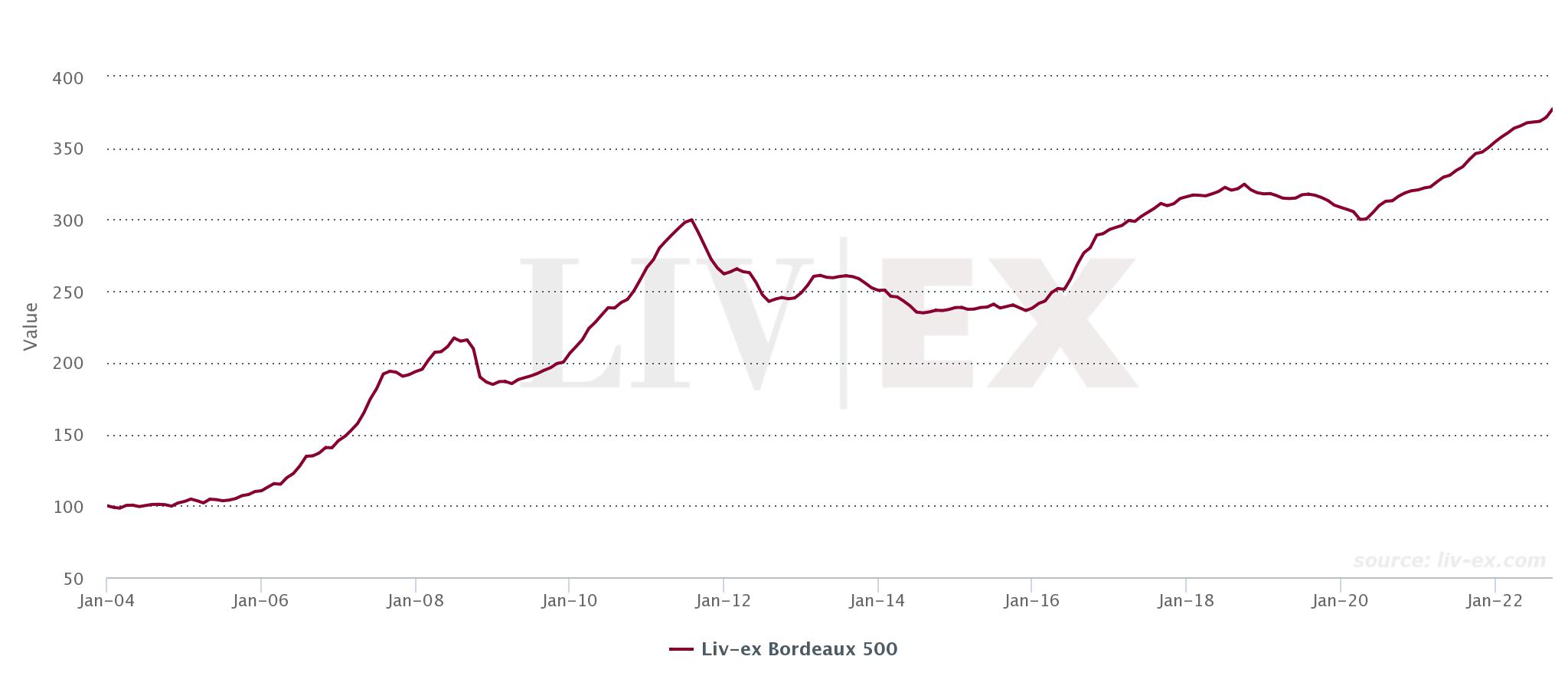

The Bordeaux 500, an index from Liv-ex for the top 500 wines of the region, has gained 19.3% over the last two years alone. The Bordeaux 40, which tracks 40 wines hailing from older vintages of exceptional quality, has gained 21.7% in that same time frame.

When you break it down into specific bottles, returns can be higher, but the lower diversification increases risks of volatility. For instance, the 2014 Chatau Figeac has seen Liv-Ex market prices rise over 70% in the last five years.

Source: Liv-Ex

Making Bordeaux a part of your portfolio

Historically, red Bordeaux sees two periods of marked value appreciation. The first is the first few years after the wines have been bottled and released. The second is when they enter their drinking windows. Two Vint collections showcase these strategies.

The Bordeaux Millenium Collection is composed of wines from the 2000 vintage; largely considered one of the best vintages in the region’s history. Noted wine critic Robert Parker stated in a 2002 article that there was “evidence that this (2000) is the greatest vintage Bordeaux has ever produced.” Twenty years later, in 2022, Sotheby’s ranked the 2000 vintage as the #1 Bordeaux vintage to own and collect right now. The millennium vintage from Bordeaux is highly sought-after by collectors looking to drink now and to hold for decades to come. Many have just entered ideal drinking windows; meaning consumption should increase, diminishing supply and driving up prices.

The Bordeaux En Primeur 2021 Collection is the equivalent of buying commodities futures. The wine is still in the barrel, waiting to be bottled. Buying “En Primeur” is perhaps one of the most appealing avenues for blue chip Bordeaux investing, as the early tastings and predictions are reliable. Again the vintages of these great Chateau are very consistent in quality, meaning investors can buy wines early, ahead of actually being bottled and distributed.