A Simple Guide On How To Start Investing In Stocks (2022)

Life is busy. Investing provides a way to build wealth while you handle all of your other day-to-day responsibilities. In other words, setting aside money for the right investments puts that money to work so that you can reap the fruits in the future.

Some investors choose one investment vehicle while others use many different ones. The right strategy depends primarily on your resources and goals, but investing in stocks is one of the most common methods for beginner investors.

If you’re interested in starting to invest, or you want to expand your existing portfolio, consider this guide for investing in stocks:

The Essentials of Investing in Stocks

Public companies allow investors to purchase shares, and those shares make up the company’s stock. When you invest in a stock, you benefit from that company growing and performing well in the coming years, whether it’s a software development company, shoe manufacturer, or wine company . As your stocks become more valuable, you may be able to sell them for more than you bought them for, thus bringing you a profit.

One of the most critical factors to consider when investing in stocks is that it is a long-term deal. It’s best to maintain a diversified portfolio without pulling out too many stocks so that when the market rises and falls, you can have consistent assets to rely on.

There’s no denying that the U.S. economy is experiencing unprecedented times. Many investors have seen plenty of reasons to sell off stocks between record-high inflation, Federal Reserve interest rate hikes, COVID-19 pandemic restrictions, and the Ukraine invasion. Nonetheless, most financial advisors suggest their clients buy and hold their investments.

Perhaps the most effective way to start investing in stocks is to contribute to an online investment account. This allows beginners to invest in stock shares or mutual funds.

Many brokerage accounts will allow you to purchase single shares, while some even provide paper trading as an option. Paper trading shows you how to trade through stock market simulators to be more prepared when you put in your real money.

How to Get Started Investing in Stocks

- Pick your approach

- Study stocks and funds

- Open your investing account

- Establish your stock market budget

- Keep tabs on your stocks

- Play the long game

If you’re looking for a smooth introduction to investing in stocks, it’s crucial to plan out your steps and make intelligent decisions along the way. Following these tips will help you do just that:

Pick Your Approach

Stock investing is not a one-size-fits-all practice. There are several different strategies to consider; the one you choose should align with your goals and resources.

For example, you could take a hands-on approach and select your own stocks and stock funds. This would entail learning how to compare investment opportunities and choosing the proper accounts.

Or, you could opt for a financial expert to handle most of the process. Using a robo-advisor could be ideal if you wish for a more passive approach because it would provide you with low-cost investment management. Many major brokers and independent advisors offer robo-advisor services that will invest your money into stocks and funds that match your specific goals.

Then, there is investing in your 401(k). If your employer provides a 401(k) plan, and especially if they will match your contribution, it can be an excellent way to begin your investing journey. This is because it teaches you fundamental strategies, such as regularly contributing small amounts, taking a passive approach, and concentrating on the long game. Your 401(k) likely won’t offer any individual stock opportunities, but you will have some stock mutual funds to choose from.

Study Stocks and Funds

If you decide to manage your own stock investing, one thing you will need to learn is how to choose which investment opportunities are worth pursuing. There are two primary types of investments to study:

Individual Stocks

Some beginners have specific companies in mind for their investment strategies. If that's the case, you can purchase a few shares or even a single share to get started in stock investing.

If you have the time to research and the capital to invest, you can use many individual stocks to build a diverse portfolio. But it's essential to remember the market fluctuations that come with individual stocks.

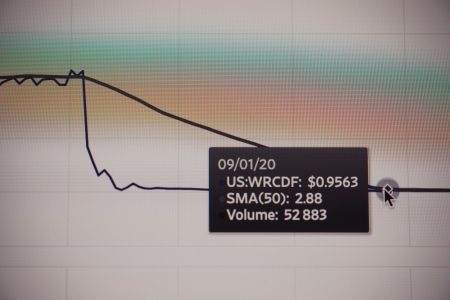

It will help you remember why you chose the company you invested in during down periods. For instance, if you invest in a wine stock, you might remind yourself that you got into it because of your love for wine.

On the other hand, stock mutual funds are diversified by nature, leaving you with less risk. Most investors are better served by relying primarily on mutual funds to build their portfolios, especially those who are putting retirement savings toward investing.

With that said, keep in mind that individual stocks are more likely to increase exponentially. Selecting your individual stocks wisely can pay off, especially if you choose a number of stocks that outperform the market.

Mutual Funds and ETFs

You can buy small portions of several stocks through a single transaction when you invest in mutual funds. Two of the most popular mutual fund types are ETFs and index funds; these funds track an index. Investing in a mutual fund means that you own small shares of each company. By combining multiple funds, you can quickly create a diversified portfolio.

Open Your Investing Account

You will need to open an investing account to begin investing in stocks. This typically entails a brokerage account for investors who aim to take an active role. But going with a robo-advisor makes sense for those who prefer some assistance. Both brokers and robo-advisors will let you open an account with minimum capital.

Using a Robo-Advisor

You can use a robo-advisor to reap the benefits of stock investing without having to do the work of choosing individual investments. These services handle all investment management tasks.

Robo-advisor companies administer an onboarding process to learn about each individual's investing goals before creating a personalized portfolio that aligns with those plans.

Sure, you will have to pay management fees for these services. But they will likely be a fraction of what you would pay a human investment manager. Plan to pay about .25% of your account balance to your robo-advisor.

Going With a Broker

Going through an online brokerage is probably the best method for purchasing stocks, funds, and other investments when it comes to saving time and money. This will allow you to start an individual retirement account (IRA). If you are already contributing to another type of retirement plan, such as a 401(k), then you can open a taxable brokerage account.

When choosing a broker, you must consider several factors, such as account fees and trading commissions. You will also want to go over the investment selections of each candidate; commission-free ETFs are ideal for those who prefer funds.

Establish Your Stock Market Budget

As with any other financial decision, you must set a budget when investing in stocks. This means determining how much capital you will need to start and how much money you should invest in stocks.

Determining Your Opening Costs

Ultimately, the cost of the individual sharers you purchase will tell you how much money you need to purchase an individual stock. Some shares are priced at a few dollars, while others cost several thousand dollars.

Going with an exchange-traded fund (ETF) is ideal if you have a limited budget and prefer mutual funds. Though mutual funds often require you to open with at least $1,000 (or more), ETFs trade like stocks and sell as shares, meaning you may be able to start investing in an ETF for less than $100.

Determining Your Investment Amount

When investing in funds, you can contribute a sizable portion of your portfolio to stock funds. This is particularly the case if you have a long horizon.

For instance, a 28-year-old investing in retirement may have 75% of their portfolio in stock funds while allocating the rest to bond funds. If you are using individual stocks, it's best to keep them as a small portion of your portfolio.

Keep Tabs on Your Stocks

As an investor, it's not good to obsess over daily fluctuations, but it is helpful to regularly check your stocks and other investments to keep up to date on the big picture.

Typically, reviewing your individual stocks and mutual funds a few times a year will suffice. The key is to ensure all of your investments align with your goals.

Play the Long Game

Investing in stocks is one of the most tried-and-true methods of building long-term wealth. However, some investors get into trouble when they forget they are playing the long game.

You also must consider that several years will be much higher or lower than that, while individual stocks will prove even less predictable, so patience is crucial.

“Wining” Down

Investing in stocks wisely will put your money to work as you navigate daily life and allow you to reap the rewards later on. Consider the information and advice above as you begin your stock investing journey.

If you are passionate about investing in wine and wish to diversify your portfolio, work with a platform like Vint that offers SEC-qualified shares of wine and spirits collections. You may even consider researching wine stocks to invest in in the coming months and years.

Sources: Paper Trading: What It Is and How It Works | NerdWallet What Is An Employer's 401(k) Match? | Forbes Advisor 5 Best Stock Tracking Apps To Monitor Your Investments | Money Under 30