Investing in wine is becoming increasingly popular, but like any investment, it carries risks. However, with proper knowledge and a well-thought-out strategy, you can minimize those risks and try to make profitable investments. In this article, we will share with you valuable tips and strategies on how to invest in wine while minimizing the risks involved.

Understanding the Wine Market

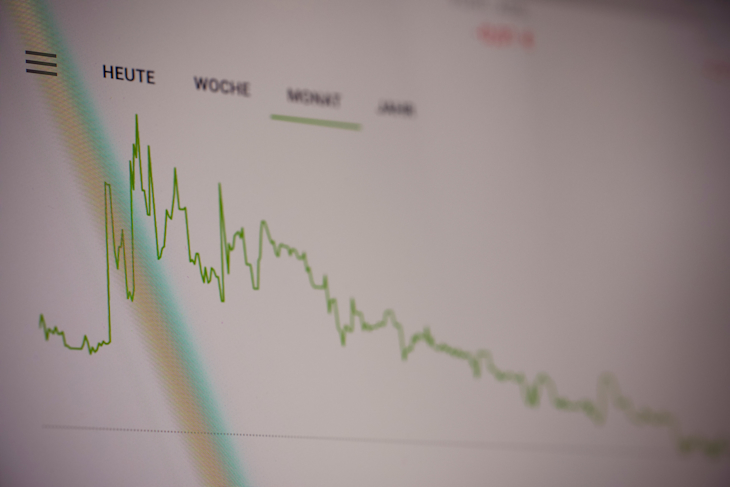

To invest in wine, you must first understand the wine market. This includes knowledge of wine regions, grape varieties, and vintages. Wine is a luxury item that is subject to supply and demand. Therefore, investing in wine requires you to keep up-to-date with the latest wine trends and market movements.

Setting a Budget

Before investing in wine, it's essential to set a budget. Investing in wine can be expensive, so you need to know how much you are willing to spend. Your budget should include not only the cost of the wine but also storage, insurance, and any other associated costs.

Investing in Blue-Chip Wines

Blue-chip wines are those that have a proven track record of increasing in value over time. These wines come from prestigious vineyards, have excellent aging potential, and are in high demand. Investing in blue-chip wines can be a safe bet, as their value tends to hold over time.

Diversifying Your Portfolio

Diversification is key when investing in wine. It is recommended that you invest in different wines from various regions, grape varieties, and vintages. This way, you spread the risks and ensure that you have a balanced portfolio.

Building Relationships with Wine Merchants

Building a relationship with a reputable wine merchant can help you minimize the risks involved in investing in wine. A good wine merchant can advise you on the best wines to invest in, help you navigate the wine market, and provide you with valuable information on wine trends.

Investing in En Primeur

En Primeur is a term used to describe the practice of buying wine while it is still in the barrel. This allows you to purchase wine at a lower price than its potential market value. However, this strategy requires patience, as it can take several years for the wine to be bottled and released.

Storing Your Wine Properly

Proper storage is essential when investing in wine. Wine needs to be stored in a cool, dark place with a constant temperature and humidity level. This ensures that the wine ages properly and maintains its value over time.

Insuring Your Wine Collection

Investing in wine can be risky, and accidents can happen. Therefore, it's essential to insure your wine collection against loss, theft, or damage. This gives you peace of mind and protects your investment.

Selling Your Wine

Knowing when to sell your wine is crucial when investing in wine. It's recommended that you hold onto your wine for at least five years before selling it. This allows the wine to mature and increase in value. However, it's also essential to keep an eye on the market and sell your wine when the time is right.

Alternatively You Can Invest With Vint.co

Vint provides unique opportunities to diversify into wine and spirits at a fraction of the cost via securitized offerings. This means much of the logistical, educational, and capital barriers are removed to building a broad portfolio.

Conclusion

Investing in wine can be a profitable venture, but it requires knowledge, strategy, and patience. By understanding the wine market, setting a budget, investing in blue-chip wines, diversifying your portfolio, building relationships with wine merchants, investing in En Primeur, storing your wine properly, insuring your wine collection, and knowing when to sell your wine, you can minimize the risks involved in wine investing.

Disclaimer: The information provided in this blog is for educational and informational purposes only and should not be construed as financial advice. Investing in any asset carries a risk of loss, and readers should do their own research and due diligence before making any investment decisions. The author and publisher of this blog are not responsible for any losses, damages, or other liabilities that may arise from your use of the information presented here.