Announcing New Wine Futures From Vint

Today we are introducing a new type of offering, Vint En Primeur, futures from the New World. This is the first Vint futures offering from outside of France, and an example of our continued efforts to provide the Vint community with a diverse range of investment opportunities.

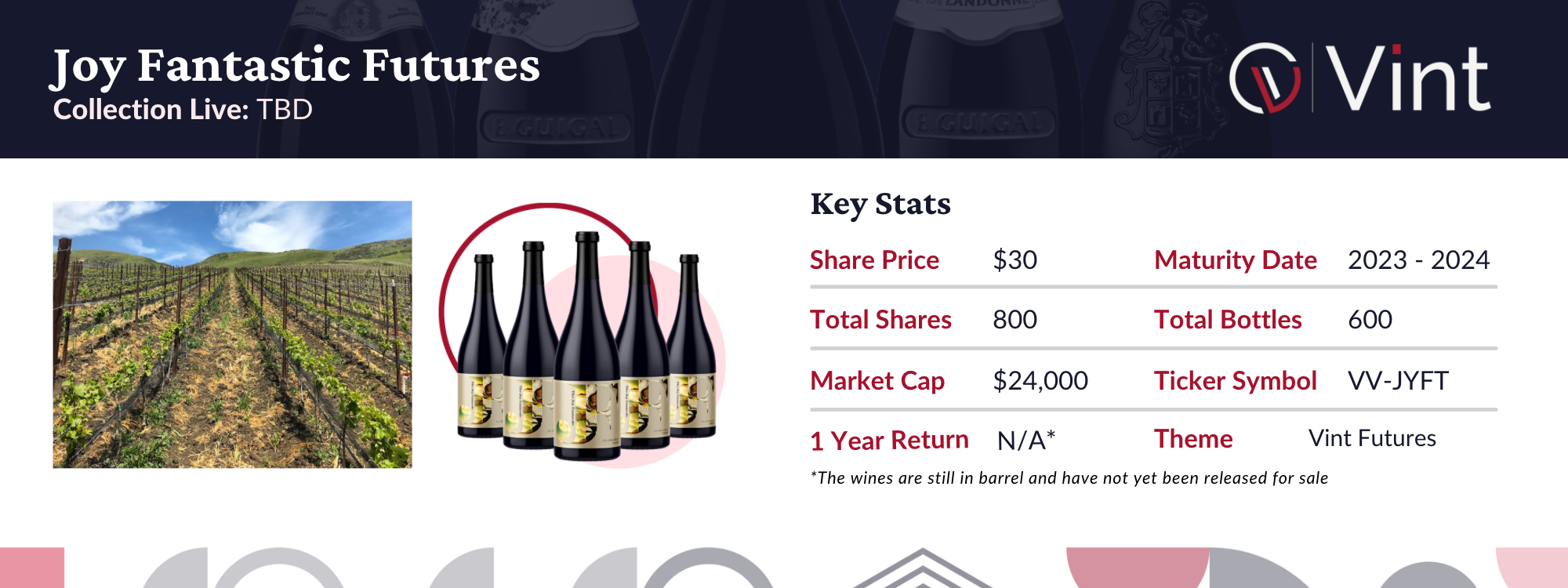

These wines are currently maturing in barrel and will be bottled and released in 2023. Produced by Amy Christine, MW, and veteran winemaker Peter Hunken, The Joy Fantastic Syrah has received praise from critics, including 95 points and a “Cellar Selection” designation from Wine Enthusiast for the 2018 vintage.

The Vint team has had the opportunity to work alongside Amy as we have grown Vint, and we are elated to be able to offer this collection featuring The Joy Fantastic label.

Wine Futures Explained

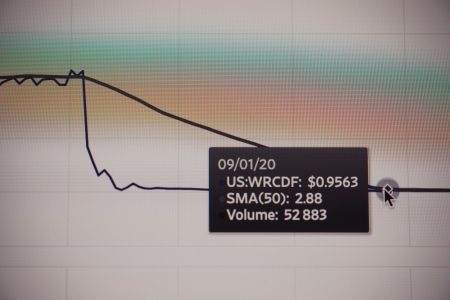

Wine futures have been around for hundreds of years, dating back to the 18th century. Traditionally, futures have been limited to the most well-known or recognizable wine regions in the world, Bordeaux, Burgundy, and the Rhone Valley.

Futures allow for wine producers to "pre-sell" a portion of their inventory as it ages over the coming ~18 months. In some years, this is critical for cash flow and vineyard operations. The purchasers of the future contracts benefit by receiving advantageous pricing on what are typically tough-to-acquire labels that have historically appreciated in value.

Access

Here at Vint, we pride ourselves on making the wine world more accessible, whether it is making blue-chip wines like DRC or Lafite Rothschild investable for less than $100 or creating content that helps our investors better navigate the world of wine.

We see Vint En Primeur as an extension of this access. We are uniquely positioned to offer non-dilutive capital to producers, which will allow them to operate under less stressful financial conditions. And at the same time, Futures provide a unique investment opportunity to our investors.

Futures can add stability to a portfolio by providing access to investment-grade wines under their projected retail value. This built-in value can be a great way to diversify risk as you spread your investments out across several offering types.