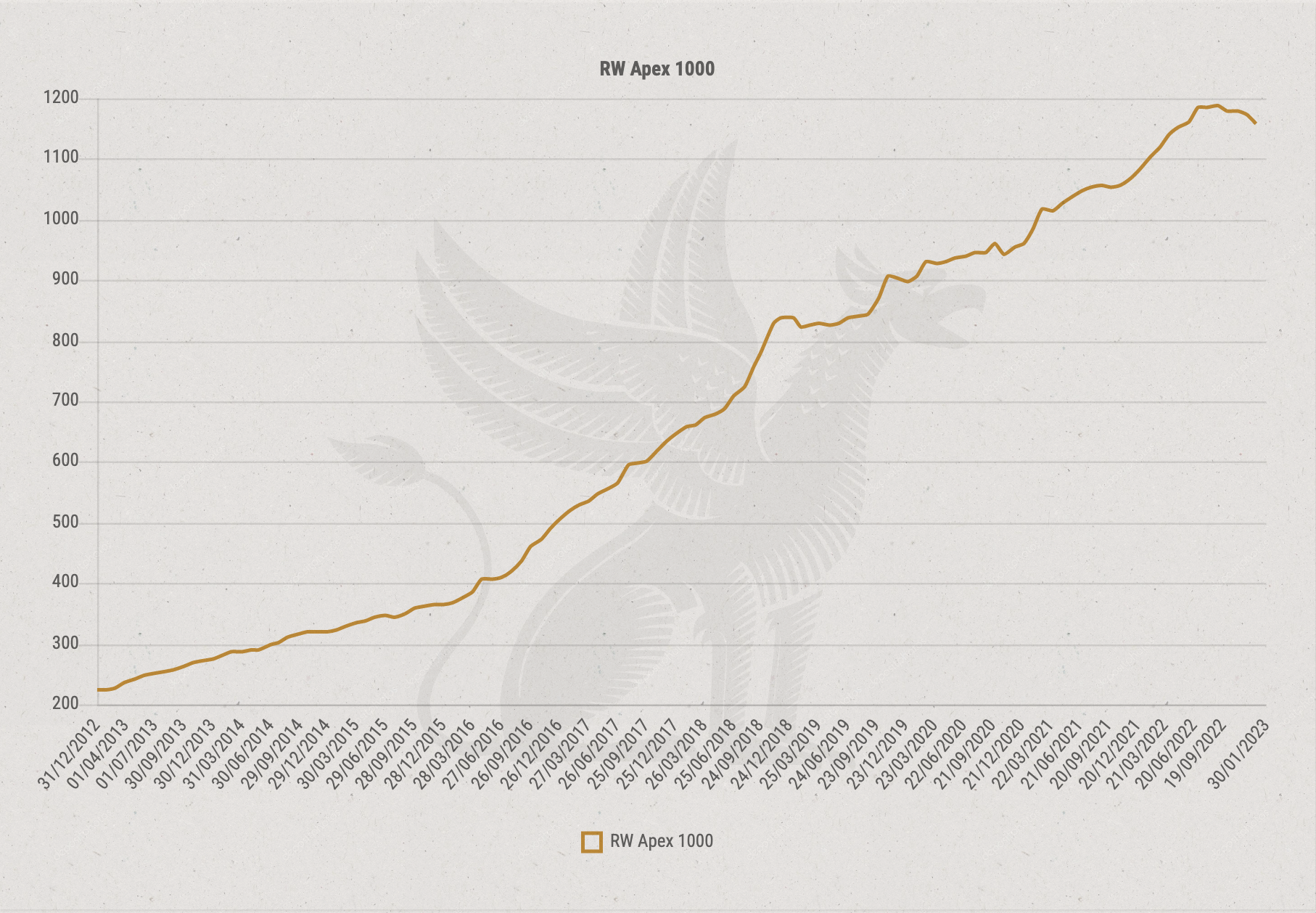

2022 gave the investment community a pretty compelling glimpse into the merits of whisky investing. Rare Whisky 101’s RW APEX 1000 index, a measurement of the market, saw a 6.85% gain last year, compared to a stock market that fell 19.4% (gauged by the S&P 500). Whisky investing is becoming increasingly popular as a form of alternative investment as awareness increases, and as investors seek to hedge against the volatility of more traditional markets.

Here’s everything you need to know about whisky investing in 2023.

It’s Still Long-Term Supply & Demand

After a significant bull run for whisky investing, we saw a slowing through the end of 2022 and into 2023, with the market declining 0.25% year to date (based on the RW Apex 1000 index). Vint doesn’t necessarily view this as reason for panic, as every bull market cycle will eventually see softening and consolidation.

Warren Buffett advocates buying and holding stocks. Through time, those that have worried about short-term volatility have missed out on the broader gains of the S&P 500. Vint views the whisky investing market no differently, and maintains a long-term view on its offerings, based on original investment theses. Our general guidance is for a 3-7 year hold period.

Source: Rare Whisky 101

If you reference this chart of the Rare Whisky Apex 1000 index, the market has gained roughly 418.2% since 2013, compared to about 232.95% for the S&P 500.

This is an asset class driven by rarity, brand recognition, and shrinking supply which drives value through time. There are no shortcuts. The only way to create the qualities of a 50-year scotch, is to barrel and age it properly for 50 years. That makes the resulting products incredibly valuable to collectors or enthusiasts, as this is not a process which can easily be replicated.

Growing Interest

As with wine investing, the performance of last year was definitely a major factor in increasing awareness of the asset class, and demonstrating its legitimacy. Whisky is still a relatively new investment market. When we talk about investment-grade whiskies, the majority of it revolves around single malts, or whiskies made from malted barley at a single distillery. These types of whisky were largely overshadowed by blends for a long time, and were mainly enjoyed domestically in Scotland. There weren’t big developments until the 1950’s and 60’s, when the owners of Glenfiddich, and guys like Stanley P. Morrison, who bought the Bowmore Distillery in 1963, started pushing more emphasis on single malts.

The key takeaway here is that much of the current whisky investment market stems from the early days of distilleries bringing single-malts to the forefront. Now that there is a globally established market for these types of whiskies, we are witnessing rising interest in special bottlings, old casks, and unique expressions of the most coveted distilleries.

A sector of immense momentum has been Japanese whisky. The RW Japanese 100 Index has gained over 48% in the last 48 months, as investors continue to look at rare Japanese whiskies. Yamazaki, Karuizawa, these are distilleries that have created strong returns compared to other whiskies, and broader financial markets. In particular, the RWK (Rare Whisky Karuizawa) Index has gained 11.19% over the last 12 months. To give one a reference for how rare some of these whiskies are, Karuizawa is a shuttered Japanese distillery that was mothballed way back in 2000. The rarity of its remaining bottles drive huge demand on the secondary market.

Vint's Positioning

Through its whisky and fine wine offerings, Vint managed net annualized returns of 28.29% on our full and partial collection exits through 2022. One key example of a successful whisky exit was our Bowmore cask, which produced a net annualized return of 38.39%. As excitement and interest grows, we continue to work to increase the number of, and diversity of our securitized offerings available to the investment community. As retail and institutional investors alike look more to diversifying portfolios to stave off volatility, investment-grade whisky seems positioned well, even with potential softening relative to 2022.

If the market does continue to cool off after such a robust bull cycle, Vint is uniquely positioned to capitalize. Our model and approach allow us to weather short-term volatility as we source assets with consistent performance track records that may be undervalued at the time, and face no pressure to sell assets in the short term. Vint views any periods of slowdown as a potential “buyer’s market” and will look to take advantage of market conditions in 2023 to opportunistically source and further our mission of offering investors the best assets at or below estimated fair market value.