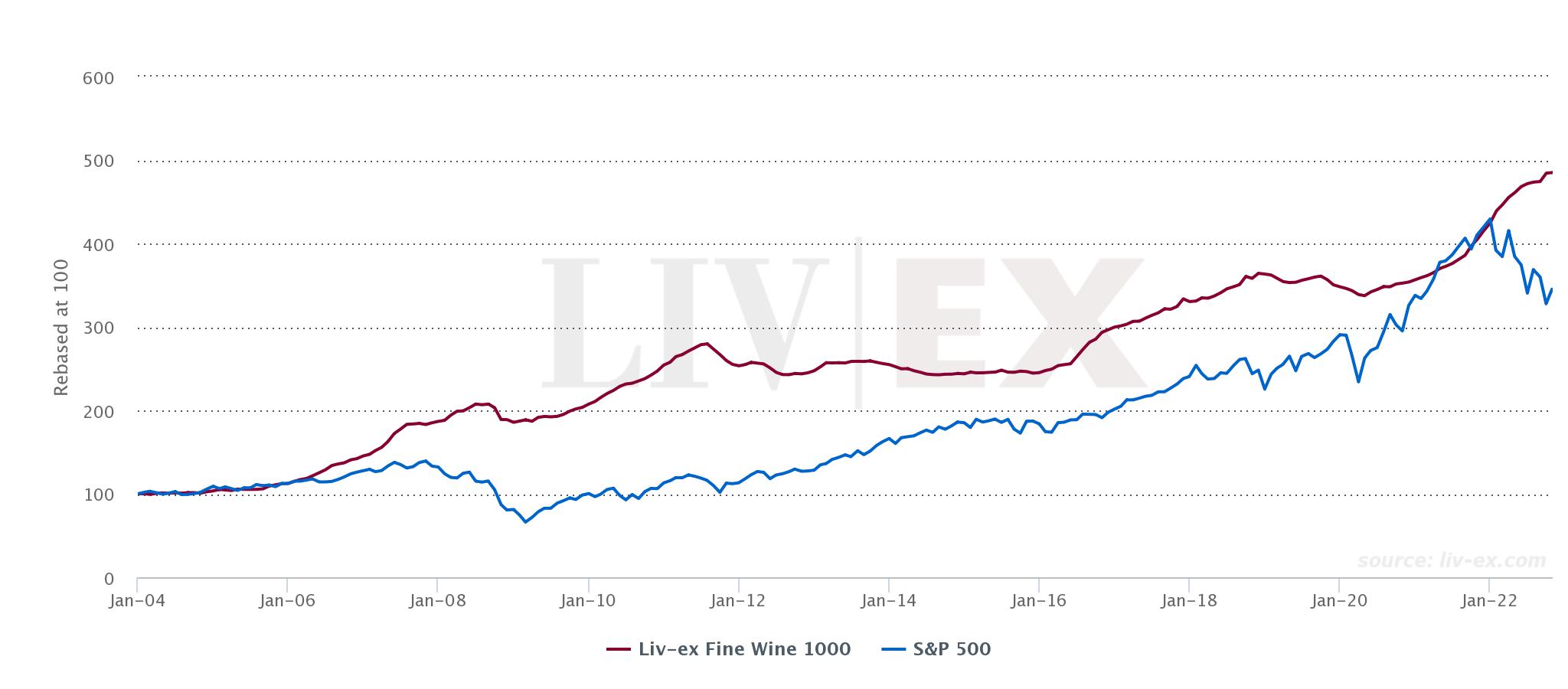

2022 was quite the year for wine investing. Major indices like the Liv-ex 1000 finished the year up 13.10%, while the S&P 500 saw a loss of 19.4%. It demonstrated the merit of wine as an alternative investment, and bolstered interest. As we brave the beginning of 2023, focus is beginning to shift to how this bull market can maintain itself. How will wine follow up such a banner year?

Here’s everything you need to know about wine investing in 2023.

“Buy and Hold” Remains The Name of The Game

After ten quarters of growth, the fine wine market (represented by the Liv-ex 1000 index) slowed down in the fourth quarter, declining 0.86%. This flat trading seems to be the result of collectors and investors taking a breath going into 2023, as interest rate hikes and mixed economic signals in Q4 left uncertainty in the economy.

The beauty of wine investing is that short term volatility typically means very little. The rules have not changed here. Much as Warren Buffett advocates buying and holding stocks, most wine investing trends revolve around the long game. This is an asset driven not by earnings reports, but by supply and demand. The simple dynamic of consumption and aging of wine through time can lead to increased value for the remaining bottles of a good vintage. Vint maintains a long-term view on its offerings, based on original investment theses. Our general guidance is for a 3-7 year hold period.

Who’s Leading?

The market is Burgundy and Champagnes’ to lose. The two sub regions were the definitive leaders coming into 2023, with the Burgundy 150 index and Champagne 50 index finishing 2022 up 26.7% and 18.7% respectively. Both indices cooled going into the end of the year, and Liv-ex’s December 2022 report pointed out that many Burgundies are becoming more and more expensive. As this happens, there is potential for wine investors and collectors alike to begin looking for relative value; a trend that is spurring the expansion of the secondary market as a whole.

Liv-ex for instance, listed the Rhône region as the most accessible entry point into fine wine right now in terms of the quality that can be obtained relative to pricing. It also noted “renewed demand” for white Burgundy, which saw its trade by value reach all-time highs last year as buyers looked for alternatives to the traditionally pricey reds.

A Buyers Market?

If the market does cool off after such a robust bull cycle, Vint is uniquely positioned to capitalize. Our model and approach allow us to weather short-term volatility as we source assets with consistent performance track records that may be undervalued at the time, and face no pressure to sell assets in the short term. Vint views any periods of slowdown as a potential “buyer’s market” and will look to take advantage of market conditions in 2023 to opportunistically source and further our mission of offering investors the best assets at or below fair market value.

While no market is impervious to ups and downs, the historical track record, and demonstrated stability through 2022 offer an encouraging view for wine investing. In times of strife such as the financial crisis in 2008, and the pandemic and subsequent shutdown of 2020, fine wine indices outperformed the stock market. In 2023, just as in any other year, patience is key.

Growing Interest

We are in a time of great development for the wine investing industry. The performance of last year was definitely a major factor in increasing awareness of the asset class, and demonstrating its legitimacy. The number of wines traded on Liv-ex beat 2021’s record, and Vint managed net annualized returns of 28.29% on our full and partial collection exits. As excitement and interest grows, we continue to work to increase the number of, and diversity of our securitized offerings available to the investment community.

As retail and institutional investors alike look more to diversify portfolios to stave off volatility between stock markets and real estate, wine seems positioned well, even with potential softening relative to 2022.