With multiple new opportunities to invest in blue-chip wine and spirits coming to the Vint platform every month, it can be difficult to know how to allocate free funds into a diversified portfolio. There are many different approaches to building a thoughtful wine and spirits portfolio, so we wanted to share some data to help you make sense of our offerings and develop your own unique investment strategy.

Our wine team places a strong emphasis on current and historical market data to make decisions about which producers and bottles to source for our collections. We’ve compiled some of this market data to give you a closer look at how the world of fine wine functions.

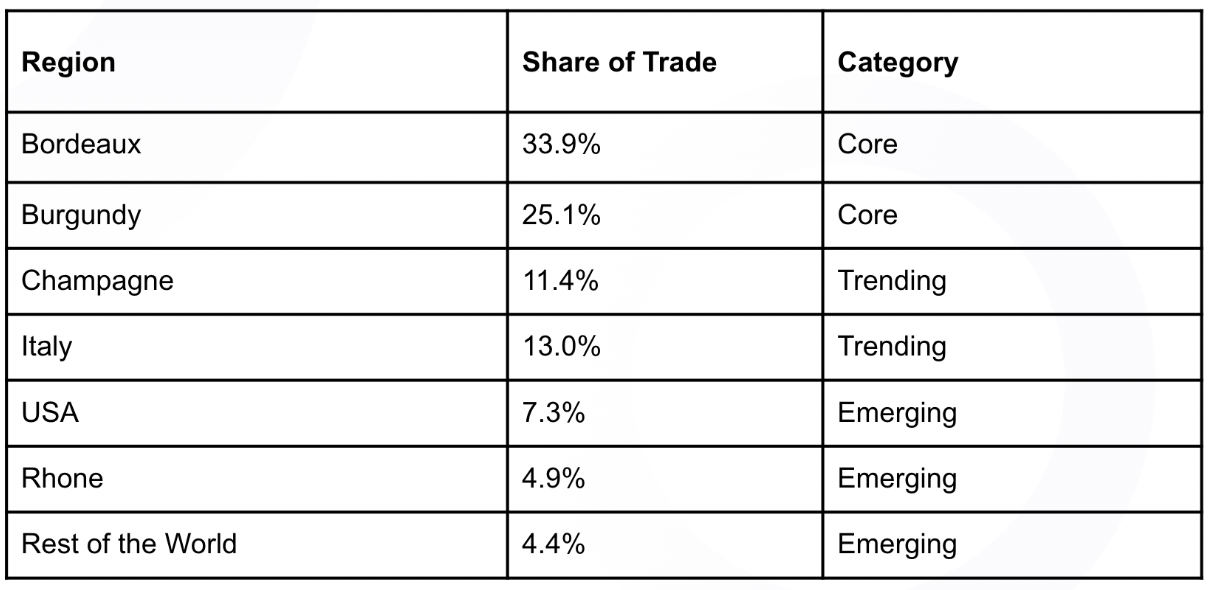

For instance, did you know that USA wines only account for around 7.3% of trading volume in the most popular fine wine markets? Conversely, wines from France’s Burgundy, Bordeaux, Champagne, and Rhone regions combine to account for over 75% of the entire collectible category by dollar value traded.

Information about trading volume in the global market can help individual investors think critically about their own portfolio allocation. Some investors may choose to follow the market trends and allocate funds in line with market trading volume, while others may choose to place larger bets on the smaller regions with less global value share, such as the USA and Italy. There are merits to both of these strategies (and all blends in between. Here is a chart detailing the regions which make up the fine wine trade on Liv-ex (a marketplace and the benchmark index provider for our industry) as of the first half of 2022.

We added the category labels to easily display which regions we think of as making up the “Core” of the global wine trade, the “Trending” regions making material gains in market share, and the “Emerging” regions producing top wines to growing global fanfare. This chart can inform the way you choose to allocate your funds into new collections. For instance, if most of your investments are in wines from Italy, you may want to explore some of the other regions that make up more of the global trade, to add balance and broader exposure. Emerging and trending regions can perform really well, but regions and producers with the longest track records tend to offer the most stability in your portfolio. Many investors try to strike a balance between new opportunities and well-established stability.

If you have thoughts on a possible allocation strategy or just want to talk with one of our team members about our collections, the next step would be to set a call with our Investor Relations Associates. We can help you better understand the assets you own, or help you implement a particular strategy on the Vint platform.

We’re glad to have you in our community and can’t wait to share more about alternative assets with you!

DISCLAIMER: This blog post is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors and risks in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. Vint and VV Markets, LLC are offering securities pursuant to Regulation A. The offering circular, as amended, can be found on the SEC's website.