Overview The principles of supply and demand are integrated into almost all aspects of economics. The basic premise is that as demand increases for items in limited supply, the price of the items should increase. This reality holds true for the collectible wine market and is amplified due to the finite and limited production levels of the world's top wines. Moreover, additional factors, including region, producer, vintage, and drinking windows, impact supply and drive demand in the collectible wine market.

Producer & Region The visibility, reputation, and prestige of a region can heavily influence broad-based consumer demand for its wines. On the supply side, strict quality rules combined with limited availability of high-quality fruit can significantly restrict the production of top-tier wine from a given region. For example, in the relatively small region of Burgundy, only 1% of all vineyards are classified as Grand Cru (the region’s top designation). While this scarcity isn’t the only factor driving prices upward in Burgundy, it does help to put the impact of regional supply on market price into context.

The producer and vintage are also major factors influencing demand. Once a producer develops a strong reputation for making top wines, their brand recognition and global demand can supersede the impact of region or vintage. Vintage is the crowning stone on the pyramid when most collectors value a wine. Many collectors identify favorite regions, then preferred producers within those regions, and finally, what impacts how much they are willing to pay for a bottle comes down to the quality of the vintage, with top years commanding much greater attention, and in many cases, higher prices, than others.

Drinking Window A wine’s drinking window is another variable that can directly impact supply and demand in the fine wine market. Collectible wines are unique in that they can mature and improve for decades. Over the years, age ranges or "drinking windows" have been outlined for when specific wines may be at peak quality, thereby providing the greatest drinking experience to the consumer. Drinking window estimates are often provided alongside the tasting notes and quality scores of the major wine critics and vary by wine and vintage. As wines approach and enter their drinking windows, demand among ‘drinkers’ (as opposed to ‘traders’) tends to increase. Accordingly, consumption tends to increase, removing supply from circulation. The confluence of increased demand pressure and diminishing supply can often be a catalyst for step-change increases in price.

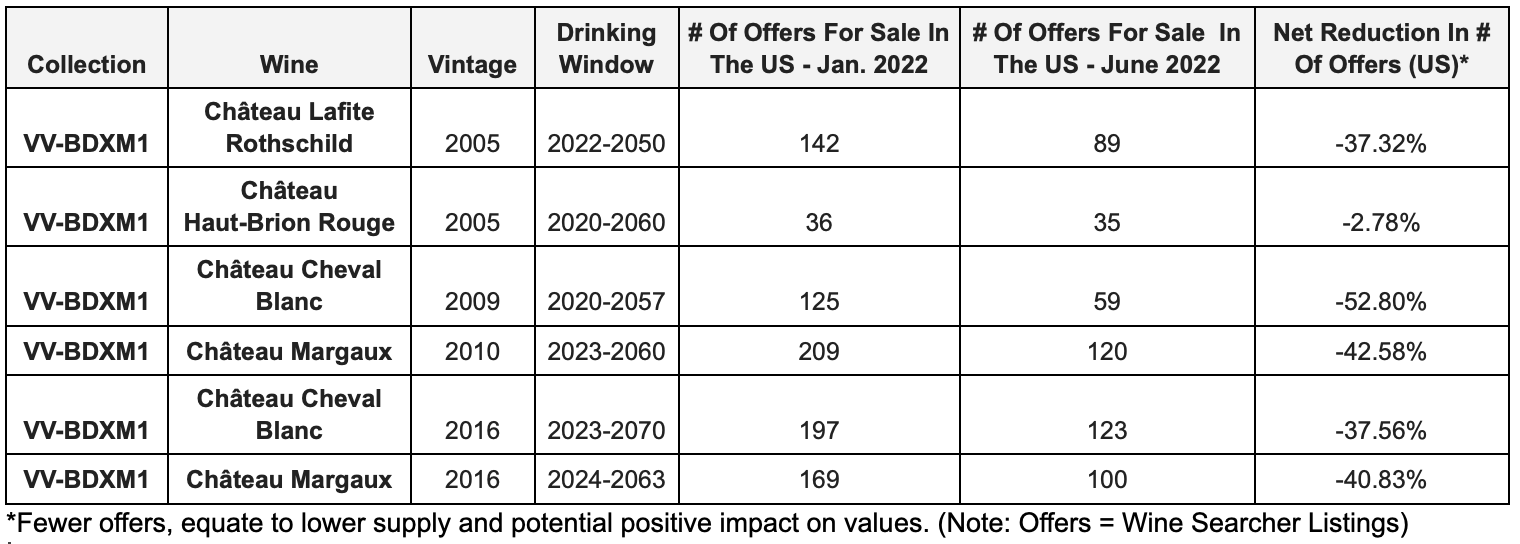

Let's look at our Bordeaux Superstars in Magnum Collection as a real-world example. In the chart below, you can see that these wines are at the cusp of or have recently entered their respective drinking windows, which is one possible reason why we have seen a significant decline in availability over the last six months.

This decline in availability is often more significant in large format sizes (such as magnums) as they are typically produced in far lower quantities than the standard 750ml bottlings.

Supply Chain Another significant influence on collectible wine supply and demand is supply chain complexity, which adds barriers to acquisition as well as cost. High shipping costs due to product weight and distance, extreme levels of regulatory complexity, or one-off major disruptions like the COVID-19 pandemic are all examples of this. As an example, certain countries, like the United States, have a very fragmented and complicated regulatory structure for importing and distributing alcohol. Although the United States is the top global market for wine, this complex structure can serve to constrain supply and add cost unless the sourcing entity is fluent in navigating this environment.

Wrap Up These are some of the key considerations which feature in how the team at Vint analyzes the market and a few of the factors that we consider when choosing wines for collections. We believe that understanding the broader factors driving the price of a bottle of wine is always helpful to know whether you are buying a bottle for consumption or for investment purposes.

DISCLAIMER: This blog post is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors and risks in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. Vint and VV Markets, LLC are offering securities pursuant to Regulation A. The offering circular, as amended, can be found on the SEC's website.*