How It Works

Vint - The Future of Wine Investing

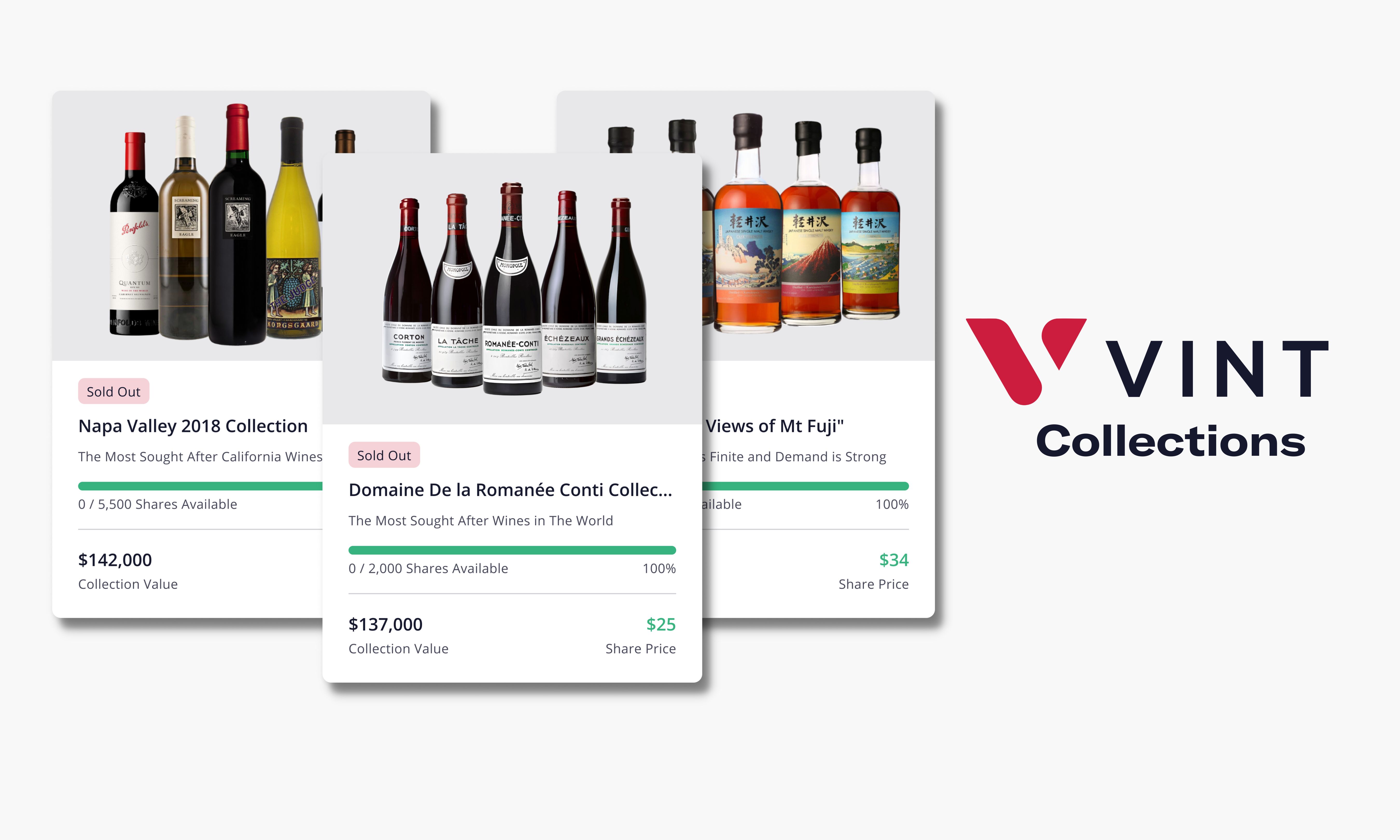

Vint's collection curation approach to wine and spirits investing sets us apart. With Vint, real people with decades of experience in the wine & spirits investment industries do the hard work of sourcing incredible collections to enable you to diversify your investment portfolio. No more “Magic AI” or being stuck with individual bottles you can’t sell. We are proud of our platform and sourcing process, and we want to show you exactly how everything works from collection development to the final sale.

Building A Collection

Our in-house team leverages extensive market research and analysis to develop and source each collection. The wines are then transferred to one of Vint’s partner climate-controlled professional storage facilities where they are monitored, insured, and kept in pristine condition. Check out our past and current offerings on our collection page

Vint then determines the collection and share price of each collection before launch by taking the purchase cost of the wines and adding a one time fee that averages at approximately 0-35% (see FAQ and offering circular for relevant disclosures).

Buying Shares

Once an offering is filed with and qualified by the SEC, we schedule a time for that collection to go live. As one of Vint’s core values is transparency, we provide extensive research and historical price data for each collection as well as comments on why our team chose to create this specific collection for our investors. All of this information can be found on the collection page and in our investment thesis.

Once you’ve had a chance to review these materials you can decide how many shares of a collection to purchase. To purchase shares, simply link your bank account or Alto IRA account and select the number of shares you’d like to add to your Vint Portfolio.

Holding and Selling a Collection

Like real estate and art, wine and spirits are typically medium to long-term investments. Each collection will have an expected sale range, but these are estimates and the actual sale may occur before or after that date. We anticipate holding collections, on average, between one and ten years. We are always watching the markets and are in constant communication with our partners and potential buyers in order to be able to act at the most optimal time to exit part or all of a collection. Our lack of pressure to sell and dynamic ability to take advantage of changes in the market sets Vint apart from others in the marketplace.

There is currently no secondary market for interests purchased in Vint offerings. Please see the footnote for relevant disclosures.

When a collection sells, we return proceeds to shareholders on a pro-rata basis and you will receive a 1099-DIV tax form. [1]

[1]: Proceeds will be used first to pay off any liabilities, including any outstanding Operating Expenses Reimbursement Obligation.